Looking Good Info About How To Apply For Homestead Exemption In Florida

In the state of florida , a $25,000 exemption is applied to the first $50,000 of your property's assessed value if your property is your permanent residence and you owned the property on.

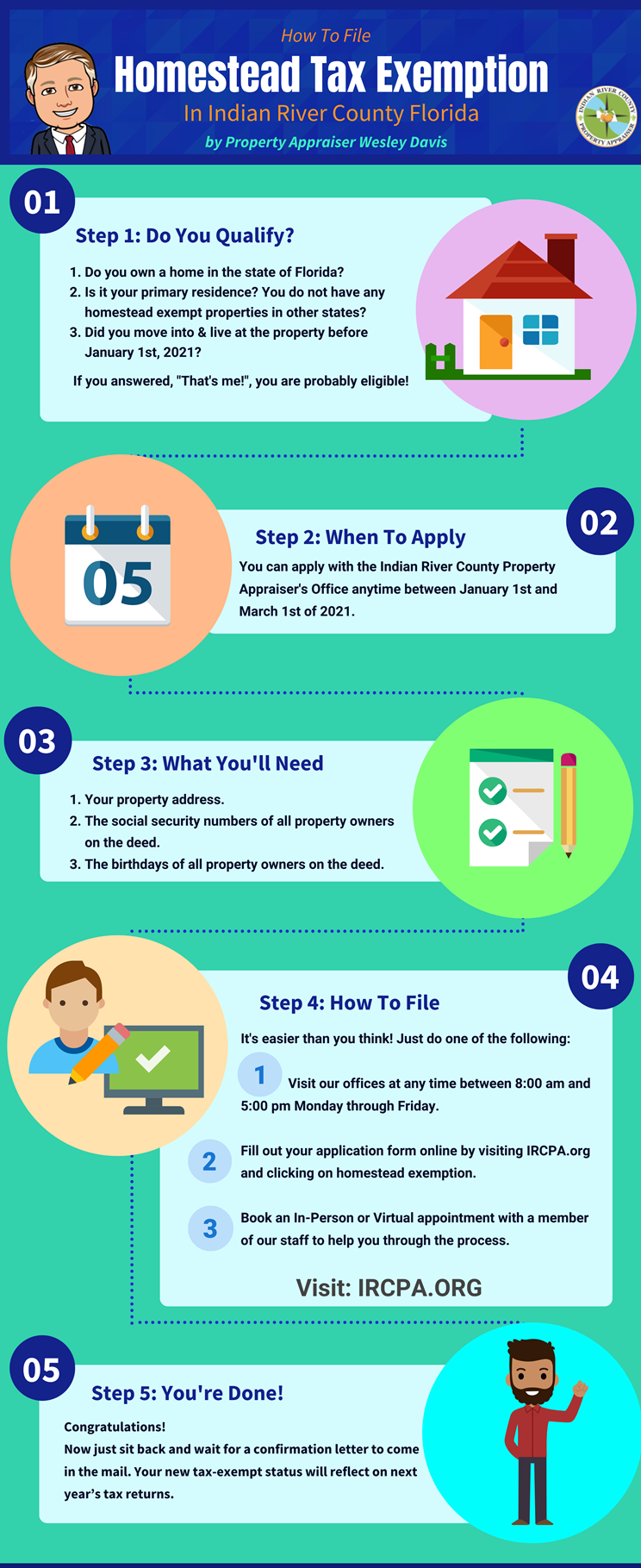

How to apply for homestead exemption in florida. There are two ways to apply, depending on certain criteria. Our online exemption application login process has changed as of february 1, 2021. In order to apply for homestead for the first time, an owner must have moved into the home prior to january 1, 2016 and it must be considered your primary residence.

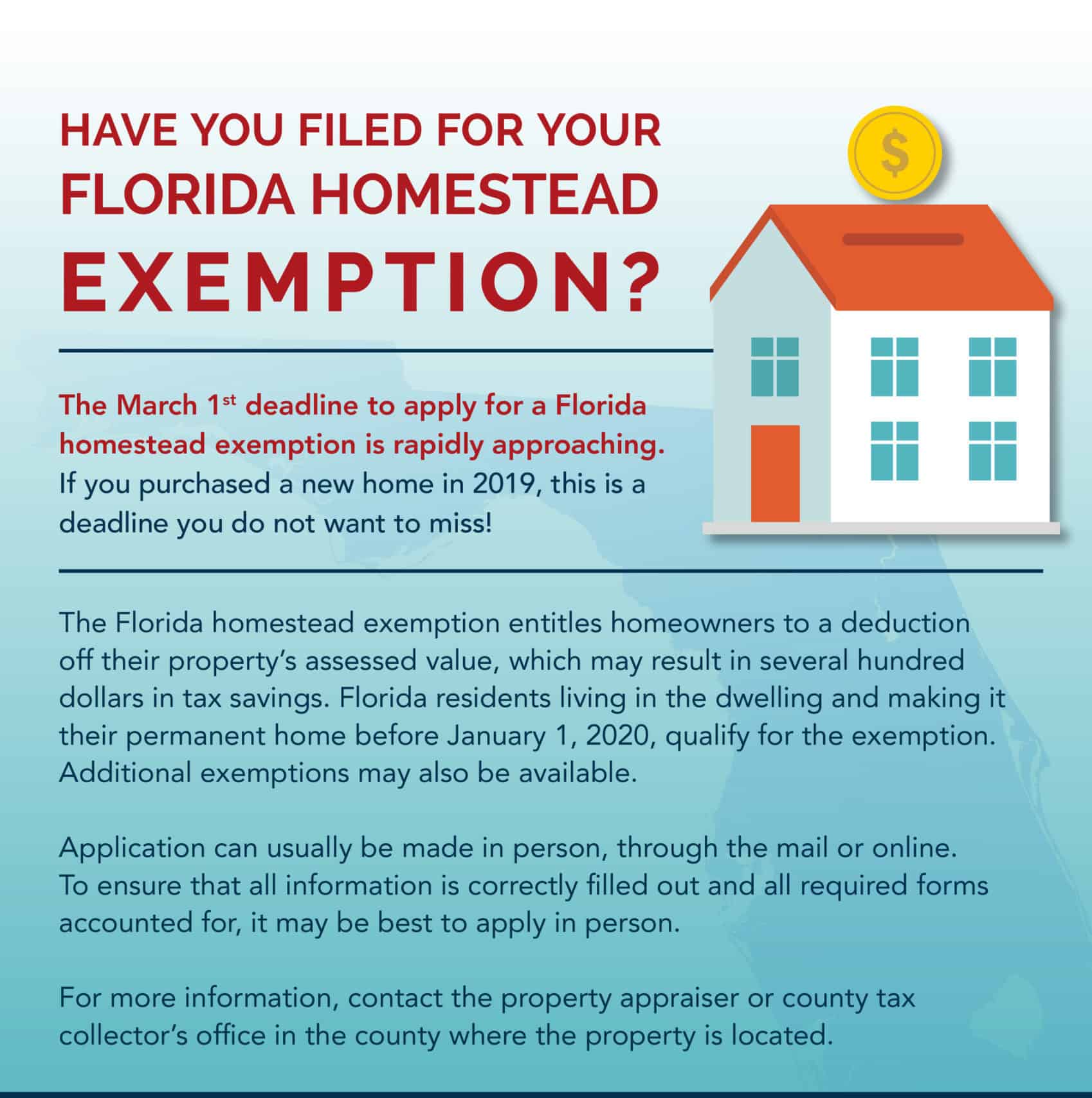

Welcome to the online homestead exemption application. Homestead exemption is a tax reduction allowable to homeowners who make their property their permanent residence. For local information, contact your county property appraiser.

If you’re planning to claim a homestead exemption, you must first. Owner should provide the address of the property, tax bill or deed/title. ( fl stat 196.011 (11) ).

Homestead exemption is $25,000 deducted from your assessed value before the taxes are calculated plus an additional homestead exemption up to $25,000 applied to the assessed. You would like to apply for an additional exemption based on the criteria described in our exemption requirements. When qualifying for the homestead exemption, you will need the following documents for all property owners applying:

Timely filed applications must be postmarked no later than midnight, march 1, of the year in. Any of the applicants have a spouse who claims homestead elsewhere. Property owners with homestead exemption and an accumulated soh cap can apply to transfer (or port) the soh cap value (up to $500,000) to a new homestead property.

Homestead exemption provides a tax exemption up to $50,000 for persons who are permanent residents of the state of florida, who hold legal or equitable title to the real. If you currently are in possession of a username. A valid florida driver’s license or state id card.