Brilliant Info About How To Become A Financial Planner In Canada

/https://www.thestar.com/content/dam/thestar/business/2022/03/23/ontario-to-regulate-use-of-financial-advisor-planner-titles-regulator/20220323090312-623b1ca82d2f2235b1d85fb5jpeg.jpg)

A bachelor's degree typically takes four years to complete.

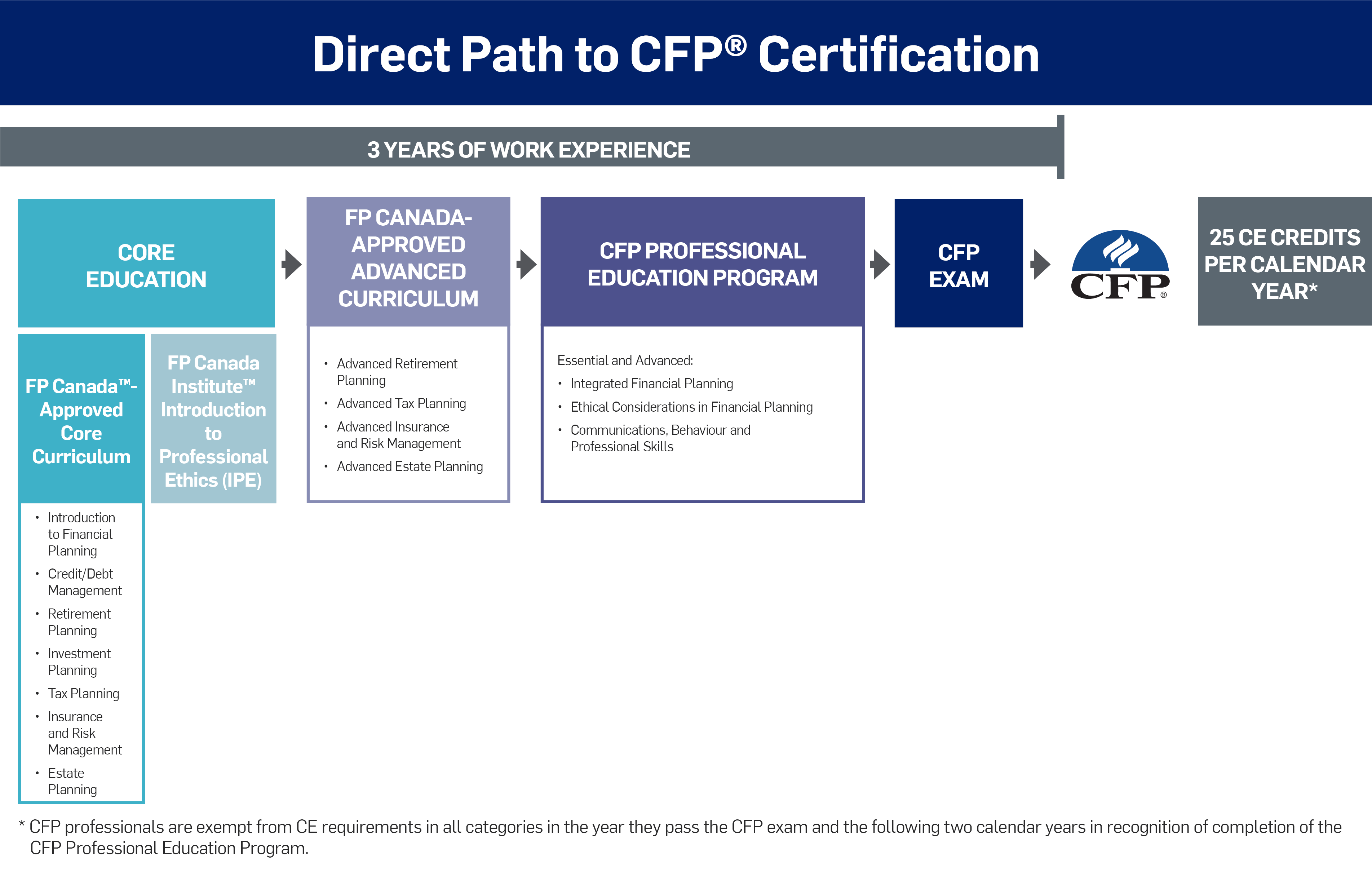

How to become a financial planner in canada. Hoping to start serving clients sooner? Since cfp certification is the standard for the industry across all of canada, the process is explained in detail here. The first step toward becoming a financial advisor is to get a job at a firm that will sponsor you for your licenses.

Becoming certified as a financial planner in canada. Earning a certified financial planner (cfp) credential can lead to career advancement. This can be in the form of a certificate, diploma or degree.

It's actually really easy to become a financial advisor. Becoming a financial advisor in canada. This can be in the form of a certificate, diploma, or degree.

What sets some advisors apart from others are education, training, experience and qualifications. Canadian investment advisors have earned a college degree in business, finance, economics, or a related. Next, you need at least a year of work experience.

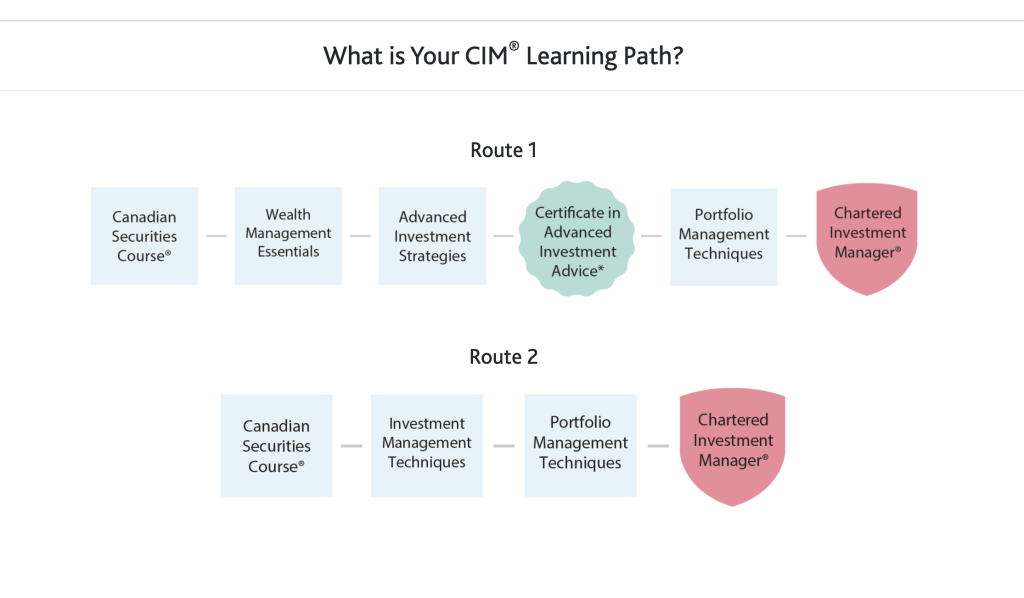

Take a weekend class, pass an insurance test, pay a few bucks and boom. Obtain certifications in financial planning: There are many designations for advisors.

How long does it take to become a financial advisor? Certified financial planner® certification and qualified associate financial planner™ certification. You will need to complete an academic program related to finance or economics before you become a financial advisor.

/https://www.thestar.com/content/dam/thestar/business/wealth/2017/03/24/how-to-pick-a-financial-advisor/advisor.jpg)

![Evolve Or Dissolve: Rethinking What It Means To Be A Financial Planner With Cary List [Ep34]](https://static.wixstatic.com/media/56c6b0_04a23554dcc346aeaee6f7214d7b2b34~mv2.png/v1/fit/w_1000%2Ch_720%2Cal_c/file.png)