Underrated Ideas Of Info About How To Buy Dividend Paying Stocks

The annual dividend amount has increased by at least 5% on.

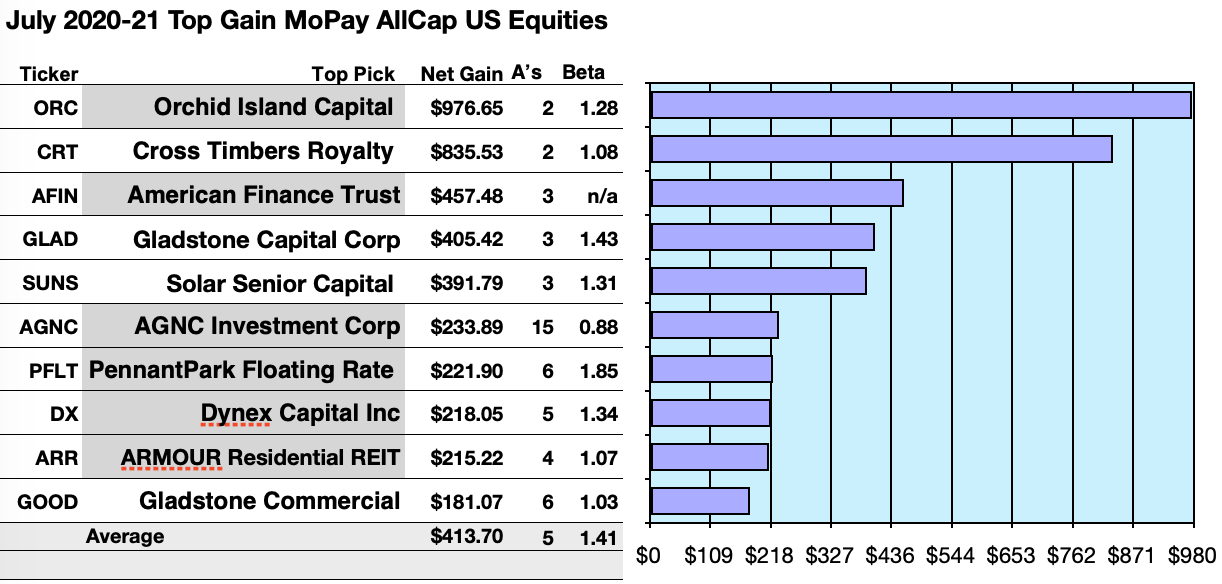

How to buy dividend paying stocks. Things to consider for choosing a profitable dividend stocks to buy 1) minimum dividend payout ratio of 40%. You can use a stock screener, see dividend etf holdings, or use dripinvesting.org to find. These top brokerages offer tools for new investors and those with years of experience.

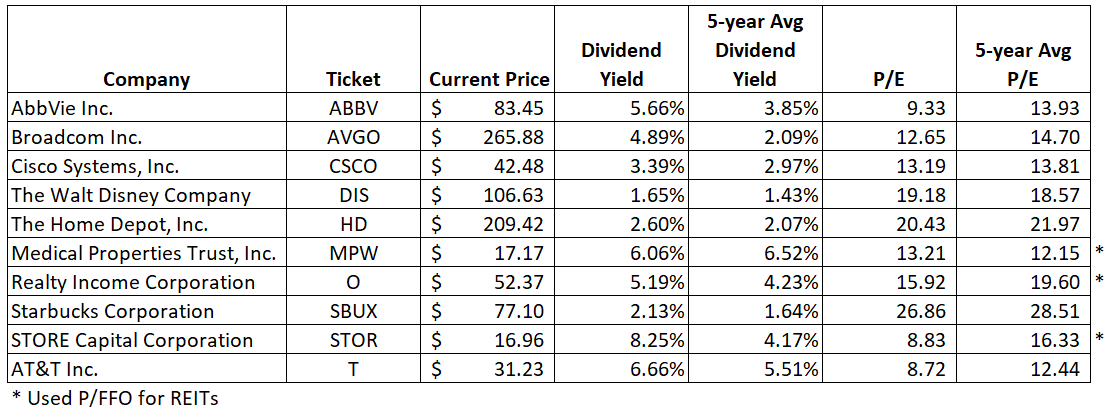

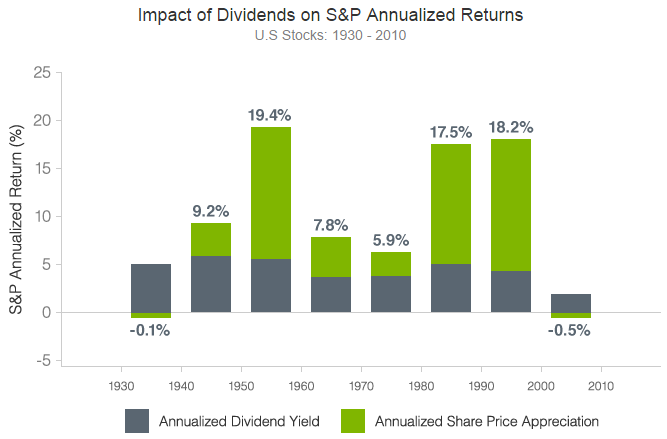

Ad we’re all about helping you get more from your money. Companies should boast the cash flow. The average dividend yield of stocks on the s&p 500 as of july 2022 is around 1.64%.

Rather than focusing on dividend yield alone, a better strategy is to pick dividend stocks that will give you steady, attractive income for the long term. To buy stocks that pay dividends, you must first find the dividend paying stock and evaluate its potential to pay dividends over time some of the key factors to consider are the. This is because i am putting.

In the third quarter, free cash flow was $4.3 billion, or 51% of revenue, which helped it pay $1.7 billion in dividends in the period. These five factors can help. The company must have increased its dividend for at least 10 years in a row.

“duke offers investors a dividend. Tips for selecting dividend payers. Broadcom's annual dividend of $16.40 per share.

Ad see why dividends may offer evidence of a company's financial strength. Although dividend paying stocks can be acquired from the stock issuing company directly, this only works for certain people and under certain circumstances. This is why the best dividend stocks tend to perform “less bad” in a market downturn.