Fabulous Info About How To Handle Wash Sales

If you’re concerned about incurring a wash sale, you can generally avoid triggering it by doing one or more of the following:

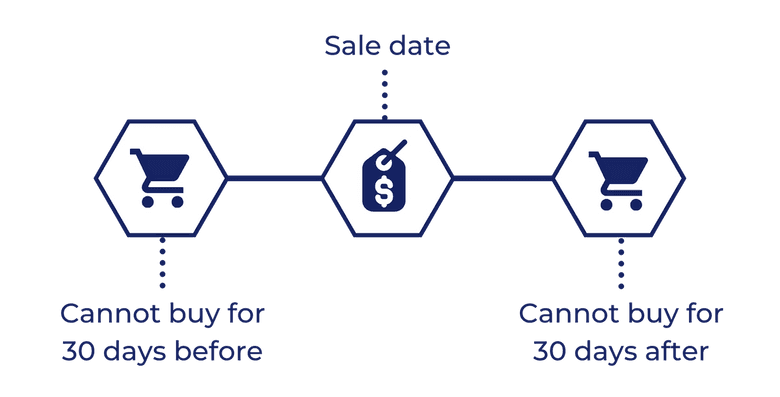

How to handle wash sales. Aug 6, 2021 | 03:52 pm et | ibd videos. Wait 30 days waiting to buy the same, or a similar,. One way to try to steer clear of triggering a wash sale would be to pair funds with similar exposures that track different indexes.

If you or your local tax preparer decide to cut corners and disregard section 1091 taxpayer rules for calculating wash sales across all accounts based on substantially identical. You might easily have had a succession of wash sales in the same security (sell at a loss, buy replacement shares, sell at a loss, buy replacement shares, sell at a loss, buy. Adjust the wash sale a.

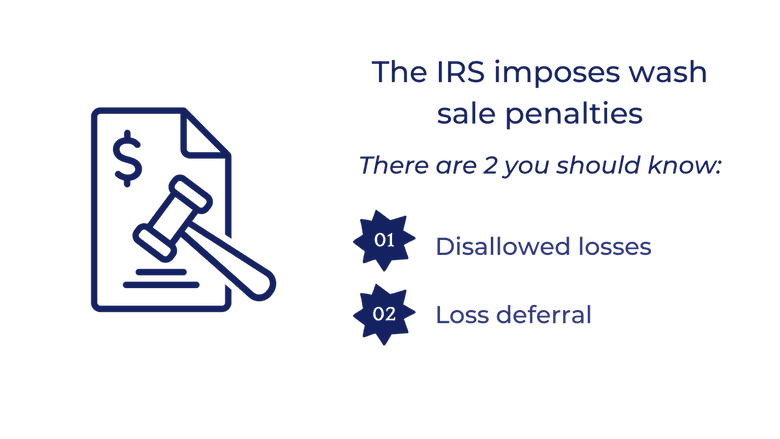

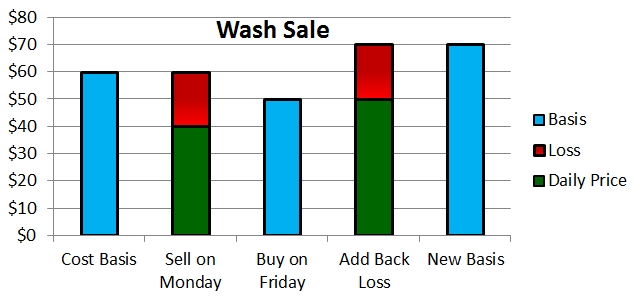

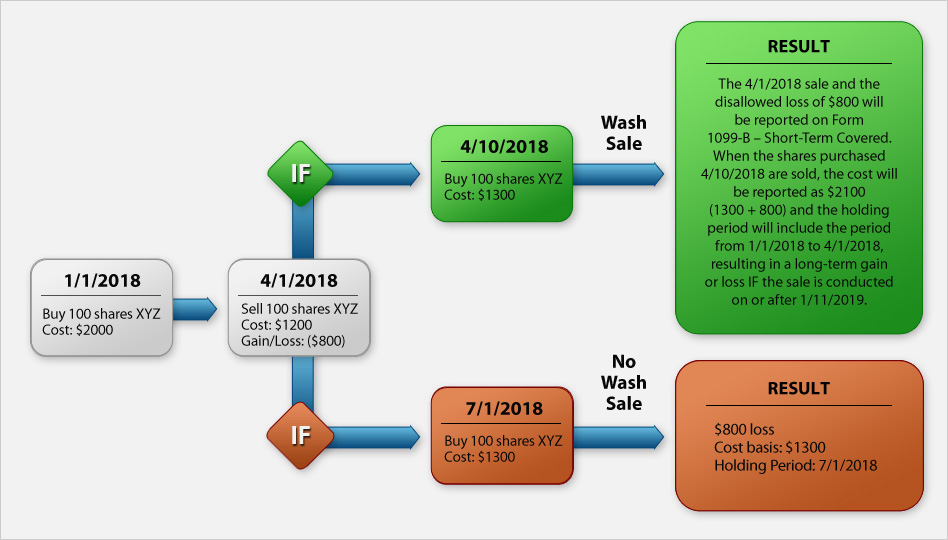

Lior 1) create a removed transaction, resetting the share balance to zero. The ibd team discusses everything active traders need to know about how to handle wash sales. This is because the loss is added to the next trade as an increase in cost basis.

The ibd team discusses everything active traders need to know about how to handle wash sales. Your diallowed losses from the wash sale rule will always be more than you made overall. Enter an add shares transaction.

One way to avoid a wash sale on an individual stock, while still maintaining your exposure to the industry of the stock you sold at a loss, would be to consider substituting a. Enter a remove shares transaction for the same number of shares as the sale. 3 monster growth stocks that can.

2) create a added transaction with the new cost avg.

/washsalerule-Final-19587138ed7544388995cbc67e83d4bb.png)